If you want to earn money from share market. So you should know what is share market? And how does it work? Also, there should be a good understanding about other things related to the share market, such as BSE, NSE, Sensex, Nifty, SEBI, Demat Account, Brokerage, Stocks, Trading, etc. Only then you can earn money from share market. Otherwise you can also lose money. So if you are thinking of investing in the stock market ! So first understand well what is the share market? And how does it work?

भारत में शेयर बाजार से पैसे कैसे कमाए ?

देश में अधिकांश लोगों के लिए पैसा निवेश करना हमेशा एक नंबर एक प्राथमिकता रही है, आखिरकार, ” आज आप जो निवेश करते हैं, वह कल आपका भविष्य बन जाता है”। शेयर बाजार जिसे पहले एक वर्जित माना जाता था, अब एक पूर्ण उद्योग में विकसित हो गया है।

शेयर बाजार में पैसा कैसे कमाया जा सकता है? आइए इसे सांख्यिकीय रूप से समझते हैं। भारत में बहुत से लोग फिक्स्ड डिपॉजिट में निवेश करते हैं। एक सावधि जमा में प्रति वर्ष 6-8 प्रतिशत का रिटर्न उत्पन्न करने की क्षमता होती है।

जबकि जब हम शेयर बाजार की बात करते हैं तो एक साल में आपका रिटर्न 100-300 फीसदी या इससे भी ज्यादा तक जा सकता है। तो, क्या यह कोई बड़ी बात नहीं है?

अब कल्पना कीजिए कि अगर कुछ साल पहले आपके पास दो विकल्प थे, एक रॉयल एनफील्ड खरीदने के लिए और दूसरा रॉयल एनफील्ड के शेयर खरीदने के लिए।

Share Market (Stock Market)

Nowadays people prefer to invest money in the share market rather than FDs (Fixed Deposits) and PPF (Public Provident Fund). Because there is very little return in FDs and PPF. That is, only 4-5% return is available after deducting tax etc. On the other hand, the condition of Saving Bank Accounts is even worse. So bad that only 2.5% to 3% interest is available. It also has a number of limitations. In this case, you are left with only two options. Either you invest in Mutual Funds . Or in the stock market .

शेयर बाजार जानें

” ज्ञान में निवेश सबसे अच्छा ब्याज देता है। “

और आखिरकार, जो कोई भी शेयर बाजार में प्रवेश कर रहा है, वह अच्छे हितों की तलाश में है। इसलिए, ट्रेडिंग में गहराई तक जाने से पहले बाजार को समझने में अपना समय लगाने की जरूरत है।

आप शेयर बाजार के बारे में कैसे सीख सकते हैं?

शेयर बाजार में उपयोग किए जाने वाले विभिन्न शब्दों और शब्दजाल के बारे में पढ़ें। समाचार, वीडियो, लेख, और सब कुछ देखें जो बाजार को थोड़ा और जानने में आपकी मदद कर सकता है।

आपको कुछ चीजों से अच्छी तरह अवगत होना चाहिए जिनमें शामिल हैं,

- आपकी ट्रेडिंग की शैली- ट्रेडिंग की विभिन्न शैलियाँ हैं जिनका अनुसरण एक व्यक्ति शेयर बाजार में करता है। आपको इस बात की जानकारी होनी चाहिए कि आप निवेशक हैं या व्यापारी।

तो एक निवेशक मूल रूप से एक ऐसा व्यक्ति होता है जो लंबी अवधि के लक्ष्यों के लिए शेयर बाजार में होता है। एक व्यापारी वह है जो कम समय में बाजार से सर्वश्रेष्ठ प्रदर्शन करना चाहता है।

Investing in Mutual Funds is quite easy. But the risk in this is very high. That is, the higher the return, the higher the risk. And the less risky plans you take, the less return you will get. That is why share market is a good option. But this does not mean that there is no risk in the stock market. The risk is high, but there are many ways to cover the risk. That is, you can cover your loss back. But this facility is not available in Mutual Funds. This is the reason why the stock market appears to be a reliable option.

I would like to tell you that in the last 2-3 years so many new investors have come in the share market! That the number of investors has almost doubled. That is, so many Demat Accounts are open during COVID-19 that don’t ask! Now not only rich people, but also middle class and lower middle class people are investing in share market. But the question is what is this stock market? And how to invest in it? Let us understand in detail.

एक अच्छा स्टॉक चुनें

शेयर बाजार सही स्टॉक चुनने के बराबर है। यदि आप अपने जोखिम को कम करना चाहते हैं और अच्छे रिटर्न की संभावना बढ़ाना चाहते हैं, तो उपयुक्त स्टॉक चुनना आवश्यक है। तो सही स्टॉक क्या है?

सही स्टॉक ज्यादातर मामलों में विपरीत लड़ाई पैदा किए बिना आपकी पूंजी को बढ़ाने में आपकी मदद कर सकता है। आपको उन कंपनियों के शेयरों का चयन करना चाहिए जिन्हें आप समझ सकते हैं और जिनके बारे में आपको अंदाजा हो।

आपके द्वारा चुने जा रहे शेयरों के लिए हमेशा कंपनी अनुसंधान करें। सभी अपडेट, वित्तीय रिपोर्ट और उस विशेष कंपनी के आसपास होने वाली किसी भी नई घटना पर नज़र रखें क्योंकि यह आपके स्टॉक की कीमतों को भी प्रभावित करने वाला है।

कंपनी के साथियों की तलाश करें और पता करें कि क्या इसका कुछ प्रतिस्पर्धात्मक लाभ है। अपने लिए स्टॉक चुनने से पहले सेक्टर विश्लेषण करना हमेशा बेहतर होता है।

Share Market What is it?

Share market is a market where shares are bought and sold. That is, shares are bought and sold. It is just like buying and selling vegetables in the vegetable market. That is, the way vegetables are traded in the vegetable market, in the same way, shares are traded in the share market.

If in simple language, share market is an open market. Where you can buy stocks of any company. And you can sell whenever you want. You just need to have a Demat Account. And the company whose shares you want to buy should be listed on NSE or BSE. Now you will ask what is this NSE and BSE ? And what is this Demat Account ? So, let us know in detail about each and every thing related to the stock market.

शेयर बाजार में गिरावट आने पर पैसा कैसे कमाए

शेयर बाजार में पैसा बनाने का विचार कम कीमत पर खरीदना और फिर इसे अधिक कीमत पर बेचना है। इसलिए, जब बाजार में तेजी या तेजी दिख रही हो, तो पैसा कमाना बहुत स्पष्ट है।

लेकिन क्या होगा अगर बाजार दक्षिण में चला जाए? क्या आप अभी भी पैसा कमा सकते हैं? इन सवालों का जवाब हां है, आप कर सकते हैं!

लेकिन जब शेयर बाजार गिर जाए तो पैसे कैसे कमाए? इसका जवाब है शॉर्ट सेलिंग या डूइंग ऑप्शन ट्रेडिंग।

शॉर्ट सेलिंग अगर सरल शब्दों में समझाया जाए तो पहले शेयरों की बिक्री और फिर खरीदारी होती है।

आइए इसे एक उदाहरण की मदद से समझते हैं। मान लीजिए कि एक कंपनी है, XYZ और उसके शेयर का मौजूदा बाजार मूल्य ₹150 है। लेकिन आप अनुमान लगाते हैं कि बाजार में थोड़ी मंदी दिख रही है। तो आप ₹150 के 100 शेयर स्टॉक ब्रोकर से उधार लेकर बेचते हैं।

बाद में बाजार मूल्य घटकर ₹100/शेयर हो गया। तो अब आप शेयर खरीदते हैं, लाभ कमाकर उन्हें ब्रोकर को लौटा देते हैं।

तो, इस मामले में, आपका लाभ 15000-10000 = ₹5000 होगा।

आश्चर्य है कि शेयर खरीदने से पहले आप कैसे बेच सकते हैं? दरअसल, आपका संबंधित स्टॉकब्रोकर आपके लिए करता है और बाद में जब आप शेयर खरीदते हैं, तो आप ब्रोकर को शेयर वापस कर रहे होते हैं।

Stock Exchange

A stock exchange is a market where the trading of stocks takes place. And for this all the necessary facilities are available. That is, everything is available from Infrastructure to Technology and from Buyer to Seller. You just have to pay some fee. If we talk about Stock Exchanges, then there are 2 big Stock Exchanges in our country . One is NSE (National Stock Exchange) and the other is BSE (Bombay Stock Exchange).

NSE (National Stock Exchange)

The full name of NSE is National Stock Exchange of India Limited . It was established in 1992. This is India’s first Electronic Stock Exchange, which is fully automated. It is a Screen-Based Trading System , which shows real-time data. Its index is called Nifty . Which is decided on the basis of the performance of the top-50 companies of the country. Hence it is also known as Nifty 50.

BSE (Bombay Stock Exchange)

The full name of BSE is Bombay Stock Exchange Limited . It was established in 1875. It is the first and oldest stock exchange in Asia. It is also the 10th oldest stock exchange in the world. Its index is called Sensex . And this index is determined on the basis of the performance of the country’s 30 largest and powerful companies.

अगर आप शेयर बाजार से 1000 रुपये प्रतिदिन कमाने के बारे में सोच रहे हैं, तो आप इन दिशानिर्देशों का पालन करने का प्रयास कर सकते हैं-

- कुछ स्टॉक चुनें जिन्हें आप लक्षित करना चाहते हैं

- कोई भी कार्रवाई करने से पहले, कम से कम 15 दिनों के लिए इन शेयरों की गतिविधियों को बारीकी से ट्रैक करें

- इस अवधि में, वॉल्यूम, संकेतक और ऑसिलेटर के आधार पर विभिन्न तरीकों से स्टॉक का विश्लेषण करें। आमतौर पर उपयोग किए जाने वाले कुछ संकेतक सुपरट्रेंड या मूविंग एवरेज हैं। आप स्टोचस्टिक्स, मूविंग एवरेज कन्वर्जेंस डाइवर्जेंस या एमएसीडी और रिलेटिव स्ट्रेंथ इंडेक्स जैसे ऑसिलेटर्स की मदद ले सकते हैं।

- यदि आप बाजार के घंटों में नियमित रूप से अपने लक्षित शेयरों का पालन करते हैं तो आप कुछ ही दिनों में उच्च स्तर की सटीकता प्राप्त करेंगे। आप मूल्य आंदोलनों की व्याख्या करने के लिए बेहतर स्थिति में होंगे।

- आपके द्वारा उपयोग किए गए संकेतकों और आपके विश्लेषण के आधार पर, अब आप अपने प्रवेश और निकास बिंदुओं को ठीक कर सकते हैं।

- निवेश करने से पहले आपको स्टॉप लॉस और अपना लक्ष्य भी तय करना चाहिए।

IPO (Initial Public Offering)

IPO stands for Intial Public Offering . That is, to make the public a partner in a private company. or selling part of the company’s stake to the public. Basically, when a company needs money, it goes to the stock market and lists itself. And launches its share. This is called IPO (Initial Public Offering). That is, the company offers its stake to the public, which can be bought by any common man.

Share (Stock)

Share means share. That is, a small part of the total share of a company is called Share . For example, suppose there is a company named XYZ, whose market value is 100 crores. And the company needs a lot of money to spread its business. But the company is not getting that much money. That is why the company wants to sell its 50% stake to the public, so that it can get cash immediately.

For this, the company makes small portions of one crore (1,00,00,000) of its total stake. And sells 50% of them (ie fifty lakh) shares in the stock market. These parts are called shares. Now suppose the price of 1 share is kept at Rs 100, then the company will get Rs 50 crore instead of 50 lakh shares. In this way a private company raises funds by selling its stake .

Demate Account

Demat account is a kind of digital locker in which your shares are kept. That is, the shares that you buy for future ( for holding) are kept digitally stored in your Demate Account . And these shares are safe in your account until you sell them.

If put in simple language, it is a digital locker just like your bank locker, in which your shares are kept. Now you will ask how and from where to open a demat account? And how much fee and what documents are needed for this? So we will talk about this in more detail later. For now, know about Trading Account.

आइए इसे एक उदाहरण के माध्यम से समझते हैं:

मिस्टर जेड, एक इंट्राडे ट्रेडर जिसने 1,00,000 रुपये के शेयर खरीदे और उसे 1,01,500 रुपये में बेच दिया, इस प्रकार दिन के लिए कुल वॉल्यूम 2,01,500 रुपये होगा।

0.1% ब्रोकरेज मानते हुए।

बिक्री मूल्य – लागत मूल्य = लाभ

रु.1,01,500 – रु.1,00,000 = 1,500

अर्जित वास्तविक लाभ 1,500 रुपये यानि 1.5% है।

अब, आवश्यक लेनदेन लागतों को लागू करते हुए प्रतिफल की गणना करते हैं।

तो, ऊपर से यह समझा जा सकता है कि लेनदेन लागत के कारण लगभग 18.35% लाभ खो गया है, ब्रोकरेज सबसे अधिक है।

Trading Account

The account with which you trade or trade shares in the stock market is called Trading Account . That is, the account with which you do transactions is called Trading Account. It is linked to your Demat Account. And whatever purchases you make from the share market, its payment is made from this trading account. If you say in simple language, then this is your Transaction Account ! In which you can buy shares by adding Funds.

Usually, when you open your Demat account from a broker, he gives you both the accounts by opening them simultaneously. That is, along with the demat account, it also opens a trading account. Because these two are linked. That is why every broker opens both the accounts simultaneously.

Now you will ask what is the difference between Trading Account Vs Demat Account ? So the difference is that demat account is just an online storage, in which digital copies of your shares are kept. Apart from this, there is no other work of demat account. But Trading Account is a transactional account, through which you do transactions. That is, they buy and sell shares. And pay for each transaction.

Intraday Trading

Intra-day trading means one day trading. That is, it is mandatory to sell the shares on the same day they are bought. Be it profit or loss. that does not matter. Although margin is available up to 5 times in this, but it is quite risky. That is why one should never do intraday trading without knowing. Because in this most people lose their money.

For example let’s say you are an intraday trader . And you bought 100 shares of Reliance Jio at the rate of Rs 2600 per share . In the hope that the share price will increase today. But instead of increasing the share price, 100 falls to Rs 2500. And the market is about to close. So in such a situation you will have to sell all the shares. And you will have to bear the loss of Rs.10,000 + Charges.

Investment

This is the exact opposite of intraday trading. In this you can hold the shares for a long time. That is, the shares bought today can be sold after 10, 15 or 20 years. This is called holding . For this you have to take delivery of shares . That is, the shares have to be ordered in their Demat Account. And for this the full price of the shares has to be paid together. There is no margin in this.

For example, suppose today you bought 1000 shares of a new company at Rs 5 per share. And paid a total of Rs.5,000. But after 10 years that company grows and becomes a big company. And his one share price increases to 2000. In such a situation, if you sell your 1000 shares, you will get Rs 20,00,000. That means 20,00,000 – 5,000 = 19,95,000 will be a profit. This is called investment .

Settlement Day

There is a settlement period of T+2 days in the Indian stock market . That is, it takes T+2 days for the delivery of shares. Now you will ask what is this T+2 day? So T means Trading Day or Transaction Day . And T+2 means Transaction Day + 2 days. This means that if you buy shares of a company today! So they will reach your demat account after 2 days.

For example, suppose today is April 07 and you bought 200 shares of a company for delivery. So today (ie 07 April) will be your trading day ( T Day ). And the next 2 days after that, ie 08 and 09 April will be called T+2 Day . That is, these 200 shares will reach your account on 09 April. You cannot sell your shares in these two days. Yes, you can sell on Trading Day. But after that can’t sell in next 2 days.

Because during this time your money is sent to the seller. And its shares are delivered to your demat account. Similarly when you sell your held shares. So you get 80% of the money instantly. And 20% money is received after two days. That is, when your shares reach the buyer ‘s demat account, then you are paid in full.

How to open Demat Account?

Now the question is how to open Demat Account? How to open a demat account? So opening a demat account is very easy. All you need is an internet enabled smartphone. And you should have your bank account, Aadhar card and PAN card. If you have all these things, then you can open your demat account in just 10 minutes.

For this, there are 2 MAN Depositories in the country. One is NSDL (National Securities Depository Limited) and the other CDSL (Central Depository Services Limited). Together these two depositories not only open new demat accounts. Rather manage them as well. But you don’t need to go to any depository. Because your broker does this work. That is, he gets your demat account opened on your Behalf.

But the problem is how to choose a broker? Because at present there are dozens of stock brokers in the country like Zerodha , Angel One, Upstock , Groww , 5Paisa, Motilal Oswal, Sharekhan, ICICI Direct, Kotak Securities, HDFC Securities and SBI Capital ? So how to choose the right broker? After all, who is the best among them? Who else charges the lowest brokerage (fees and charges)? Come on, let’s know.

Top-5 Brokers In India

If we talk about Top 5 Discount Brokers of India ! So the name of Zerodha comes first among them. This is India’s No.1 Discount Broker . While Upstock, Angle One, Grow and 5 Paisa are at number 2, 3, 4 and 5 respectively. Out of these, Zerodha and Upstock are the best discount brokers. Because their service is very good. Also, there is competition in both of them regarding the first number. That’s why both try to give better service than each other.

At the same time, there is Angle One at number three , which is a bit expensive. But in terms of service is very good. Although it offers you Free Demat Account. But its charges (especially DP Charges ) are a bit high. That’s why it is a bit expensive as compared to Zerodha and Upstock.

I would like to tell you that Account Opening Charge is charged only once. But other charges are levied again and again. That is, whenever you buy or sell stocks, then you have to pay these charges. That’s why they are very expensive. Because on every transaction you have to pay extra. That is why do not fall in the trap of Free Demat Account . Rather pay attention to Fees and Charges.

Fee & Charges Comparison

A broker charges various types of charges from its customers. These charges are very important. Because they affect your earnings. That is why you should have proper knowledge about them. Here we will compare Fee & Charges of India’s Top 3 Stock Brokers . So let’s know what are the differences in fees and charges of Zerodha vs Upstock vs Angel One :-

| Brokerage | Zerodha | Upstock | Angle One |

|---|---|---|---|

| A/c. Opening Charge | ₹200/- | ₹249/- | Free |

| Annual Maintenance Charge | ₹300/- | Free | ₹249 |

| Intraday Brokerage Fee | ₹20/0.03% (whichever is less) | ₹20/0.05% (whichever is less) | ₹20/- Per Order |

| Delivery Brokerage Charge | Free | ₹20/0.05% (whichever is less) | Free |

| F&O (Equity Future) | ₹20/0.03% (whichever is less) | ₹20/0.05% (whichever is less) | ₹20/- Per Order |

| F&O (Equity Option) | ₹20/- | ₹20/- | ₹20/- |

| DP Charges | ₹13.5/- Per Script | ₹18.5/- Per Script | ₹20/- Per Script |

Zerodha vs Upstock vs Angel One

If we talk about Fees and Charges, then Zerodha is the best in this matter. Because Zerodha’s Charges are the lowest. But Upstock is a bit expensive at the same time. Especially in the case of DP Charges . And Angle One is even more expensive than Upstock. That’s why we will choose Zerodha. Because Zerodha is India’s No.1 Stock Broker . Also its service is the best. And the charges are also the lowest. That’s why Zerodha is the best.

However, while opening the account, it charges an Account Opening Charge of Rs 200 from you. But instead you get so many features that don’t ask! Zerodha’s mobile app is enough if you want to trade from a smartphone. All the features are available in it. Also the option of Option Trading is also available. That is, Zerodha is a feature rich platform, where you get every facility. That’s why Zerodha is everyone’s favorite. Well, let us understand step-by-step how to open a demat account on Zerodha?

Required Documents

Some documents are required to open a demat account. In these, your PAN card, Aadhar card and bank account are the main ones. But apart from this your signature and photo (Selfie With A Code) are also necessary. Therefore, before starting the account opening process, prepare the following documents:-

- Aadhar Card

- PAN Card

- A Signed Copy of PAN Card

- Cancelled Cheque या Bank Statement

- Signature On White Paper

- A Blank Paper & Pen/Marker

- Bank Account Details

Save Aadhar Card and PAN Card in DigiLocker so that there is no need to upload. Save a signed copy of PAN card in your phone. Also, sign on a white paper and save its photo in your phone. And also save a canceled check or a copy of the bank account statement in your phone and keep it. So that there is no problem in between. Apart from this, keep a blank white paper and a pen or marker with you. Because it will be needed.

Open Your Demat Account

After preparing the documents, you can start the process of opening a demat account. Choose a quiet place for this. And follow the below steps.

Step-1. First of all open this link ( Zerodha Account Opening Link ) in your phone or laptop.

Step-2. By clicking on this link, you will reach Zerodha’s Account Opening Page . Here you will be asked for mobile number. You have to enter the number which is linked with your Aadhaar Card . After entering the mobile number, click on Continue and verify your mobile number by entering OTP .

Step-3. Now a new page will open in front of you. Where you will be asked for name and email address . Here you have to enter your full name (as per Aadhar card) and email address and click on Continue. On clicking Continue, an OTP will come to your email address. You have to verify your email address by entering this OTP .

Step-4. Now you will be asked to enter PAN Card Number and DOB (Date of Birth). Here you have to enter your 10 digit PAN card number and your date of birth and click on Continue.

Pay Account Opening Fee

Step-5. Now the Account Opening Fee page will open in front of you. Here you will be asked to pay the account opening fee of Rs.200. You can pay the fee through your UPI ID, Digital Wallet, Credit Card , Debit Card or Internet Banking. As soon as you make the payment, a new page will open! Where you will be asked to do Aadhaar eKYC .

Complete Aadhaar eKYC

Step-6. Now you have to complete your Aadhaar eKYC through DigiLocker . For this you have to click on Continue to DigiLocker button. And enter your 12 digit Aadhaar number and click on Next. As soon as you click on Next, an OTP will be sent to your mobile number. You have to enter this OTP and click on Continue. And Access has to be allowed.

As soon as you click on Allow, your Aadhaar eKYC will be completed. And you will see the message of success. But this is only for KYC , the account opening process is yet to come. That’s why click on the Continue button at the bottom. And complete your profile.

Complete Your Profile

Step-7. Now you have to complete your profile. Here you have to enter the first name and last name of your father and then mother. And after that you have to select your annual income in the background section. After that, in the Funds & Securities Settlement Preferences, you have to select any one option between Quarterly and Monthly. After that you have to select Time in Trading Experience . If you are new to the stock market, then you have to select the option of New.

After that you have to select your occupation . And finally you will be asked whether you are a Politically Exposed Person? So in response to this, you have to choose the option of Yes or No. And click on Continue.

Link You Bank Account

Step-8. Now you will be asked to link your bank account . Here you will get 2 options. One Link Using IFSC and the other Link Using UPI ID. You can choose any one of the two. But follow my advice, then link your bank account through IFSC Code. So that you will not face any kind of problem in future.

Well, for this , accept the Terms & Conditions by entering your bank’s IFSC Code , MICR Code and your account number 2 times. And click on Continue. If you do not know the IFSC Code and MICR Code of your branch, then you can search on Google.

Webcam Verification

Step-9. Now you have to do Webcam Verification . For this, Zerodha will ask you for permission to access the camera, which you have to allow . After that you will see a 4 digit code, which you have to note down on the blank paper. And to capture a selfie with him (as shown in the example). During this, you have to stand motionless for 5 seconds, until the selfie is captured. After taking selfie click on OK button. And upload your documents on the next page.

Upload Your Documents

Step-10. First of all you have to upload your Income Proof . For this, you can upload a copy of your ITR, Salary Slip, Form 16 or any one document from the Bank Account Statement . After that you have to upload your Signature. And finally upload the Signed Copy of PAN Card (Signed copy of PAN card) and click on Continue.

eSign Your Application

Step-11. Now you have to eSign your application form. For this you have to click on the button of eSign. And by accepting the Terms & Conditions, click on Proceed to eSign button. On clicking, you will reach the eSign page of NSDL.

Here you have to accept the Terms & Conditions and enter your 12 digit Aadhaar number. And click on the button of Send OTP. On clicking, an OTP will be sent to your mobile number. You have to enter OTP and click on Verify OTP. And on clicking, you will be redirected back to Zerodha ‘s website. Here you will see the Finish button. After clicking on it, you will see the message of Congratulations.

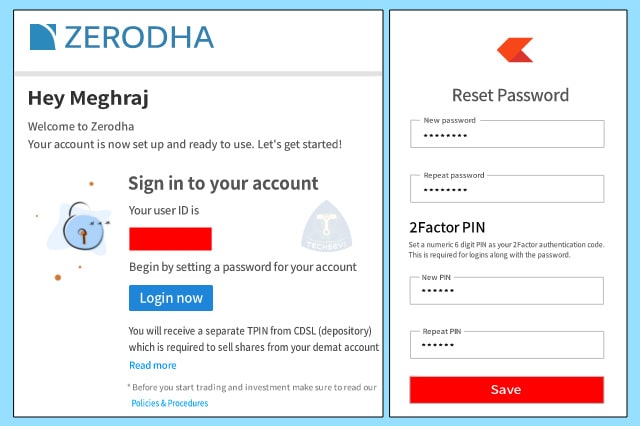

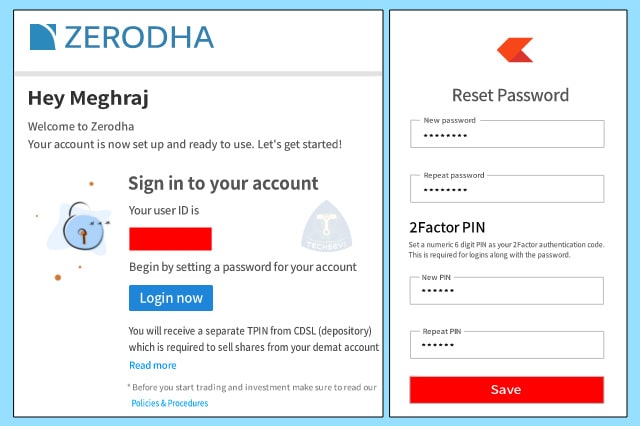

Create Password & PIN

Now you have to wait 2 days. Within two days you will get a mail, in which you will get your Login ID and a Password Setup Link. By clicking on this link, you have to create your Password and 2-Factor PIN. As shown in the screenshot below . Keep in mind, this pin will come in handy for you again and again. That is, whenever you login, then this PIN will be required.

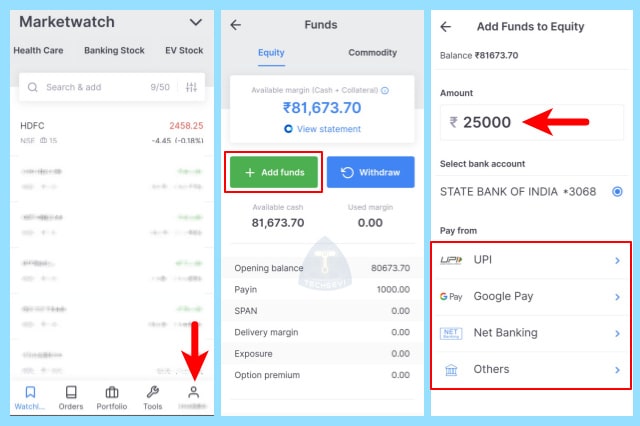

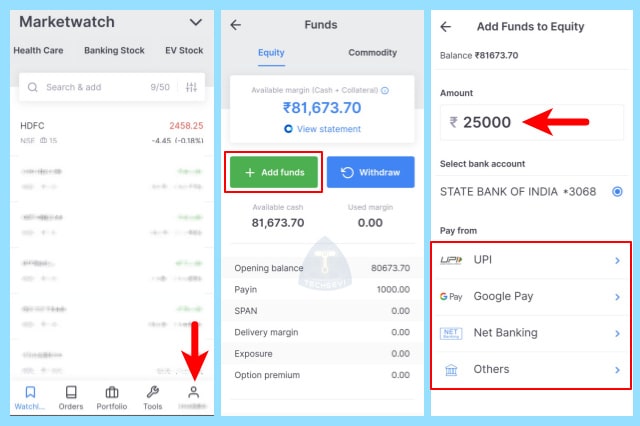

How to earn money from share market?

After creating the PIN and Password, you have to download the official mobile app of Zerodha, Kite by Zerodha . And login with the help of your Login ID and Password. I would like to tell you that while login for the first time you will be asked for login ID and password. But after that whenever you login, you will be able to login through PIN only. Well after login, you will see something like this interface, as shown in the first screenshot below.

How To Buy/Sell Shares?

Now the question is how to buy and sell shares? So for this tap on the Watchlist present in the bottom left corner . And search your favorite shares and add them to your watchlist. Here you get the facility to create 7 watchlists. That is, you can create 7 different watchlists sector wise or category wise.

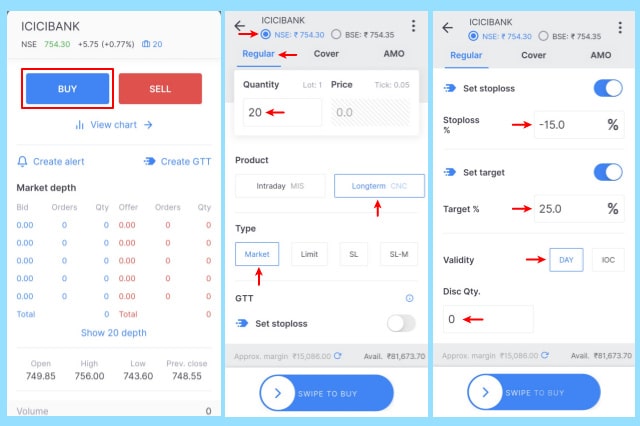

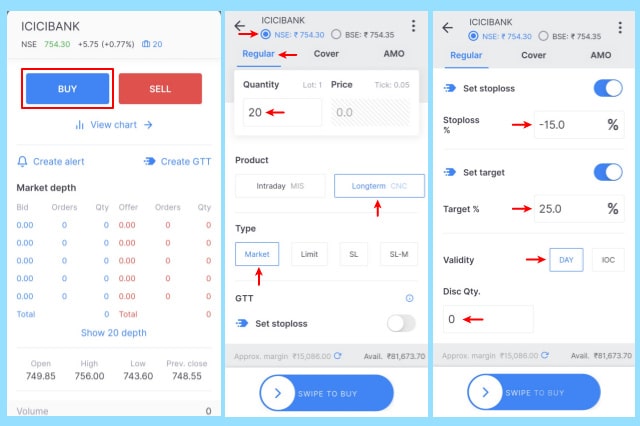

Well, after adding your favorite shares , tap on the share you want to buy. As soon as you tap, some such interface will open in front of you, as shown in the first screenshot below.

Kite App Features

Here first of all you have to select one exchange between NSE and BSE. After that select Regular in Order Type. After that the quantity of shares has to be added in Quantity. That is, how many shares do you want to buy? Write down their number. After that choose any one option between Intraday MIS and Longterm CNC . If you want to sell the purchased shares on the same day, then choose Intraday MIS. Otherwise select the option of Longterm CNC for delivery.

After that select any one option from Market , Limit, SL and SL-M in Type. If you are buying for the long term, leave the market alone . On the other hand, select Limit option for Intraday. And enter the price at which you want to buy the share. For example if the share price is Rs 754.30. And you want to buy it for Rs.752. So you have to enter Rs 752. When the price drops to Rs.752, your order will be executed automatically.

GTT (Good Till Triggered)

Well, after that the option of Stoploss has to be selected in GTT. And enter the Percentage of Loss. This is a very important feature, which is available only on Zerodha. This feature protects you from heavy losses. If you put a stoploss of 15%. So that means you will not lose more than 15%. This feature comes in handy when the price of a stock starts falling all of a sudden. In such a situation, this feature sells your shares as soon as the price drops by 15%. And saves you from being poor.

Well, after that you have to enter Percentage of Profit in Target . This is the exact opposite of Stoploss . Through this you can set your profit. Like if you want to earn 25% profit from a stock! So in Profit you have to enter 25%. This means that as soon as the share price increases by 25%, your share will automatically be sold. And you will get a profit of twenty five percent.

Well, after that the day has to be allowed to remain in validity. This feature is for special Limit Orders . After that the last option is Disc Qty. That is, Disclose Quantity . In this 20% Quantity Disclose (Public) of all the shares you buy has to be done. For example, if you are buying 200 shares, then you have to close at least 40 shares. By-default this option is 0, which means 100% quantity will be disclosed. Well, Disc Qty. After entering, Right Swipe the Arrow button. And lo ji, your order has been placed. You can view all your orders by tapping on the Orders section at the bottom.

Sell Shares On Zerodha

This is the same process for selling shares as well. All you have to do is initially choose the option of SELL instead of BUY. And after that the quantity of shares has to be entered. That is, enter the number of shares you want to sell. For example, if you have 100 shares of HDFC. And out of them you want to sell 10 shares, then enter 10 in Quantity. And after that follow the same process which was done at the time of buying. In the end, swipe right and lo, your Sell Order has been placed. You can check by going to Orders.

Share Market Portfolio

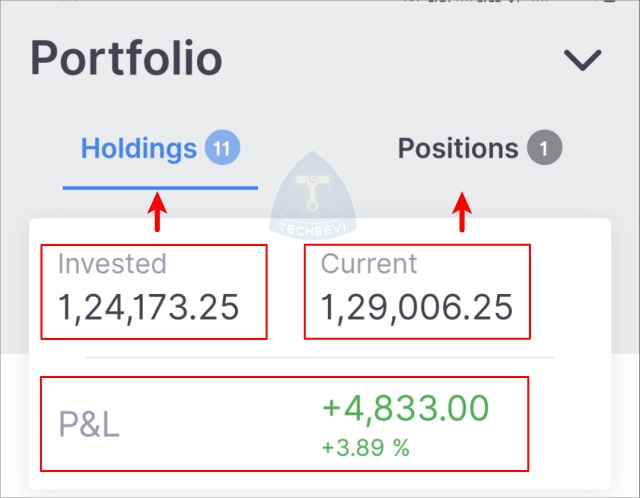

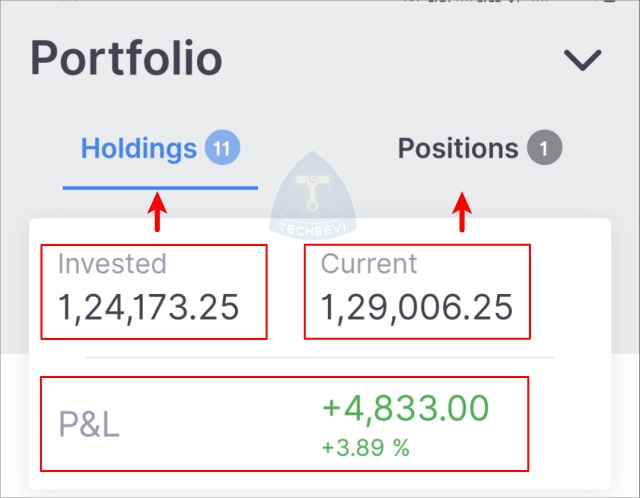

To check your portfolio , tap on the Portfolio section at the bottom of the main menu . And see the complete list of shares bought along with your total investment and current status. Here you will get 2 options. One Holdings and the other Positions.

In Holdings , you will see the shares which are in your Demat Account. That is, the shares that you bought and have reached your demat account, they will be visible to you in Holdings. Here you can see the Quantity, Buying Price, Current Price, Profit & Loss and Profit & Loss percentage of the shares purchased .

In Positions you will see those shares which are not in your demat account. That is, the shares that you bought for delivery, but have not yet reached your demat account, or the shares you have bought for intraday , will appear in the positions.

After that the next option is P&L . It means Profit & Loss. Here you can see your profit and loss. As my profit is Rs 4,833.00. This is 3.89% of my total investment. In this way you can invest and trade in Shares Market with the help of Kite App. And you can earn money sitting at home.

Share Market Summary

Share market is a place where you can earn any amount of money. There is no limit to earn money here. And the best part is that it is completely legal and transparent. There is no scope for online fraud here. Yes, you can definitely be a victim of fraud by coming under the guise of any third party company or person. But this cannot happen at the level of NSE and BSE. If there is any best and most reliable place to earn money online, it is Share Market .

The stock market is a very big and detailed topic, on which thousands of articles can be written. But still this topic will not be covered completely. In this article, we have given a basic introduction to the stock market. And told how to earn money from share market. But this information is nothing. Many techniques and strategies are used in the stock market . Also proper research is needed. That’s why get complete information before investing money.

Hopefully , through this article, what is the share market for you ? And Share Market Se Paise Kaise Kamaye ? Useful information will be found in this subject. If you liked this article then like and share it.

Share Market : FAQs

Question 1. What is Share Market?

Answer: Share market is a market where shares are bought and sold. That is, shares of companies are bought and sold.

Question 2. How to earn money from share market?

Answer: There are 2 ways to earn money from share market. One, investing and the other, trading. Investment means buying and holding shares of a company and selling it after 5-10 years, when the price of the share increases manifold. Whereas trading means buying and selling everyday. That is, it is a Daily Earning Source. In this, shares are bought at a lower price and sold at a higher price. For this it is very important to have knowledge of the market. For this technical research is required.

Question 3. What is NSE?

Answer: NSE (National Stock Exchange) is the first electronic stock exchange in India, which provides Screen-Based Trading Interface. It is Fully Automated.

Question-4. What is Nifty Fifty?

Answer: Nifty-Fifty is an index of top 50 companies of NSE. In which India’s top 50 companies are included.

Question-5. What is BSE?

Answer: BSE (Bombay Stock Exchange) is the first stock exchange in India, the oldest in Asia and the 10th oldest stock exchange in the world.

Question-6. What is IPO?

Answer: When a company launches its shares in the stock market for the first time, it is called IPO (Initial Public Offering).

Question-7. What is share?

Answer: A small part of the total shareholding of a company is called share .

Question-8. What is Demat Account?

Answer: Demat account is a digital account in which your shares are kept. That is, the shares you buy for holding are kept in this Demate Account.

Question-9. What is a Trading Account?

Answer: The account with which you trade in the stock market is called Trading Account. That is, the account with which you do transactions of shares is called Trading Account.